(THIS ARTICLE IS MACHINE TRANSLATED by Google from Norwegian)

Greece has spent 50 of the closer 200 years since they gained their independence, as insolvent or bankrupt. In 2004, Greece joined the Eurozone. It is known that Greece had cheated with the figures for its national economy, partly with the help of the American brokerage Goldman Sachs. Their entry into "the good company" meant that Greece could suddenly borrow money in euros. The country took advantage of the opportunity: A striking example is the hospital in Athens with 35 gardeners, but without a garden. Greece's first crisis came in 2010. The next one came in 2012. The EU, the International Monetary Fund (IMF) and the European Central Bank (ECB) introduced rescue packages. But Greece was not saved. By contrast, private Greek and international banks were rescued. Unsuspecting Greek taxpayers stepped down the debtor role over the heads of Greek and European politicians, and were asked to "save". Everything for private banks to survive – all determined by the troika EU, IMF and ECB. In Greece, it took six years before "corporatism" – the unholy alliance between state power and financial institutions, also called "crony capitalism" – took its toll on the Greek people.

These days, the last act of this modern Greek tragedy is played out. What went wrong and will the tragedy spread to the rest of Europe? To answer this, we take a historical look:

Jefferson's paper money. James Madison, George Washington and Thomas Jefferson were the main architects of the United States Declaration of Independence. All three understood how important it was to limit the influence of politicians on the people. Therefore, the Declaration of Independence had two main principles: "small government" to guarantee personal freedom, and "honest money" – that money was tied to a gold standard so that politicians for should be able to "make money out of thin air" – to use it for various political purposes.

The states of the industrialized world continue to print money.

When Jefferson's father-in-law Wayles died in 1773, he left property worth £ 20 plus a debt British creditors of £ 11. A good annual salary at that time was 000 pounds, so this was about great values. Many of the properties were sold, but many buyers had difficulty settling. Therefore, credit was given. But then American paper money was introduced as a legal tender in Virginia. Uncontrolled printing of money due to war led to this paper money eventually becoming worthless. Jefferson settled the land with worthless paper money, while the debt of British creditors had to be repaid in pounds. Jefferson ended up insolvent until his death on United States National Day, July 100, 4.

Gambling. The Jefferson story can explain to us what is happening to Greece and Europe if we take a closer look at the use of financial tools such as "quantitative easing" (QE) and "Fractional Reserve Lending" (FRL).

In short, FRL represents a system that is not based on real values, such as gold. It is a credit-based system without a real value base. If politicians set the banks' reserve requirements at 10 per cent, it means that a bank that receives a deposit of 100 is required to place 10 of these in the central bank as a reserve. The excess 90 is lent out. These 90 then find their way as a deposit in another bank, and this bank places 9 as a reserve in the central bank and lends 81. With a reserve requirement of 10 per cent, an initial deposit of 100 can become 1000 in total credit.

Let us use the example of Greece: the Greek state is missing 100 million euros.

To solve the problem, the state simply enters "100 million euros" on the PC, it calls one government bond, and sells this to Piraeus Bank. Piraeus Bank provides this government bond as security for a loan of EUR 100 million from the Greek central bank. This is how money is created "out of thin air".

The government bond is then sold from Piraeus Bank to the European Central Bank (ECB) for EUR 100 million. This is QE, ie the sale of government debt to the ECB. This is done through the banking system, because the ECB is not allowed to do it directly. In parallel, the ECB credits Piraeus Bank's account with the ECB of EUR 100 million.

We cannot consume ourselves for prosperity by using credit.

Based on the credit of 100 million euros, Piraeus Bank can lend 1000 million euros to its customers (or 2000 million if the reserve requirement is 5 percent). Hence the concept Fractional Reserve Lending. Vips, then the central bank system in Europe has created credit of 1000 or 2000 million euros. The newly created credit is synonymous with debt, and must be repaid by ordinary citizens sometime in the future.

The above exercise means that the Greek state via the banking system eases 100 million euros in debt to the ECB, at the same time as up to 1000 million euros in newly created credit is eased into the market – provided that the banks dare to indebt themselves and their customers further, and that customers also dare the same. With this newly created debt, citizens can borrow money for private consumption, and politicians can finance spacious social reforms. In practice, the banks have been run as a casino with depositors' money as a stake. In other words, what our politicians, central banks and financial institutions have been doing is reindeer herding gambling with citizens' money.

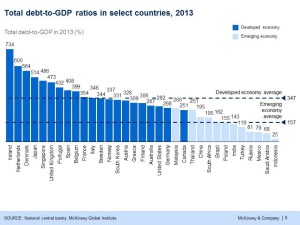

Today's money printing. The money printing system Jefferson was subjected to in the 1770s is the same as large parts of the industrialized world have now been subjected to for the last 30-40 years. This irresponsible monetary and credit policy – implemented by the authorities and central banks – with greedy banks and financial institutions on the team, has led to an unmanageable debt burden. The following diagram illustrates the problem (see blue below):

Today's money printing. The money printing system Jefferson was subjected to in the 1770s is the same as large parts of the industrialized world have now been subjected to for the last 30-40 years. This irresponsible monetary and credit policy – implemented by the authorities and central banks – with greedy banks and financial institutions on the team, has led to an unmanageable debt burden. The following diagram illustrates the problem (see blue below):

Why is the above level of debt problematic?

Let's say that the debt in the above countries was as large as the Gross Domestic Product (GDP): 100 percent, or 1: 1. Furthermore, that the debt is serviced at an interest rate of 5 per cent, and that nominal GDP (GDP in the diagram above) grows by 3 per cent. Then the debt in ten years will amount to 163/134 = 122 percent. The calculation shows that debt becomes a serious problem when it amounts to more than 100 percent. The official debt of Greece is currently estimated at 180 percent of GDP, which means that Greece will never be able to save or grow away from this. It is a mathematical impossibility. Who stays with black money? (See yellow below.)

The scale is in quadrillion, that is, a thousand trillion. The world's total GDP / GDP is about 80 trillion US dollars. Total financial assets (stocks, bonds, derivatives) amount to 2000 trillion US dollars.

In other words, financial assets are 25 times larger than the real economy. It takes almost $ 2000 trillion in financial assets for the real economy to go around? Of course not. The inflated numbers are still a result of the previously mentioned Fractional Reserve Lending (FRL) and still new financial products.

But who benefits from this? Those who benefit from this system are the banks' shareholders and "creditworthy" customers. Secondly, the banks' employees and the bank's management, who have ever higher salaries, bonuses, options and severance packages. "Creditworthy" companies / customers in which the banks use borrowed money to buy shares also have clear benefits from this. But not least, politicians benefit from this, as they can use the credit to finance the welfare state's expenses – as a grant to the "Gladmatfestivalen", "Foreningen for støy", or a "Navarsete tunnel" in Western Norway. The politicians' popularity and position of power thus increase socially and economically in society, beyond the banks and investment environments.

European politicians have been pushed into a corner. They sacrifice the citizens before they sacrifice their political life.

This above unholy alliance is called "Crony Capitalism" – politicians and big business earns a fortune at the expense of every man. The losers are the middle class and the poor.

When politicians and the European Central Bank justify debt acquisition (QE) by saying that they want to stimulate the market to increase consumption – and thus also production and growth – this is nonsense. There is no lasting and good solution if we can buy even more TVs and mobile phones on credit. We cannot consume ourselves for prosperity by using credit.

When the central bank recently initiated debt repayment (QE) of 60 billion euros a month, it means that the banking system can create unlimited credit – money there is no real value behind. It is in reality a pyramid scheme with taxpayers' money, because the newly created credit is a debt that must be settled at some point. Indebted and insolvent banks and states can not settle. It falls on you and me, our children, grandchildren and great-grandchildren.

Rothbard's warning. In 1993, the American economist Murray Rothbard was asked what he thought of the idea European Monetary Union (EMU), which became today's EU. Rothbard replied that EMU was a terribly naive idea – because politicians will always be tempted to spend money they do not really have, on all sorts of "good causes". Politicians would be tempted to pursue an overly expansionary fiscal policy, which in turn would lead to large deficits and debt in all EMU countries.

Instead of taking the consequences by making visible and taking responsibility for "his failed project", Rothbard believed that politicians would put their prestige into saving EMU, "cost what it would cost". Rothbard predicted a hopeless economic disability in which politicians would use the situation to blame the free market, and thus demand even more regulation and supranational political control – among other things through a common European banking union.

Rothbard warned against what he called the democratization and disenfranchisement of the European people – the abolition of independent, free nations – and reminded that this in turn could lead to war in Europe. It is over 20 years since Rothbard spoke about EMU. So far, Rothbard has been right in his prediction.

Today's situation. In the period from 2008 until today, government debt in Greece has increased from about 220 billion euros to about 500 billion euros. This has happened despite massive aid packages of several hundred billion euros from the EU, the ECB and the IMF. Greece barely managed to repay an installment of 750 million euros last week. Greece "found" a deposit in the IMF that almost covered the amount. The ECB has provided unsecured loans to the Greek central bank of 115 billion euros, without most people being aware of it. How can such an undemocratic process take place? European politicians have been pushed into a corner. They sacrifice the citizens before they sacrifice their political life.

A collapse of the world economy is inevitable.

The states of the industrialized world continue to print money. The whole thing is a giant pyramid scheme where current and future generations end up paying the bill for today's consumer and debt party.

In 2008, the total outstanding bond debt in the world was just under $ 70 trillion. Today, the debt is more than 90 trillion dollars. The world's total financial instruments (derivatives market) have increased from about $ 750 trillion in 2008, to $ 2000 trillion today. The financial market's players rejoice over a stock exchange and housing party, while the middle class is indebted to the unrecognizable. More and more internationally renowned economists agree that a collapse of the world economy is inevitable. The calculation below illustrates this:

The Fiscal Cliff-calculation (USA as an example – figures from 2013, it is worse today).

We use official figures for government finances, remove eight zeros, and pretend that the figures apply to a family:

Salary income: $ 33

Consumption: $ 58

Negative Balance / Deficit: $ 25

New credit card debt: $ 25

New outstanding credit card debt: $ 218

Budget cut: $ 590

This family is hopelessly bankrupt. Despite bottomless debt, the money race continues unabated. This is exactly what we have been doing in Europe, the United States and other industrialized countries, and what our politicians want to continue with. When the time of reckoning comes, politicians will ask us to show "social responsibility" while confiscating even more of their citizens' money: Remember that the trust they ask for is to solve the debt problems of taking on even more debt that can never be serviced.

Today's politicians continue to issue "blank checks". This will go wrong anyway.

Olav is a financial journalist at Ny Tid. He holds a master's degree in economics with a major in finance from the University of Miami, USA. Olav has for a number of years worked in the shipping and brokerage profession, as well as for a foreign Private Equity company. Olav has experience from various board positions both nationally

and internationally. (All rights reserved Rebel Yell Publishing, www.rebel-yell.info)